Trading Desk Workflow

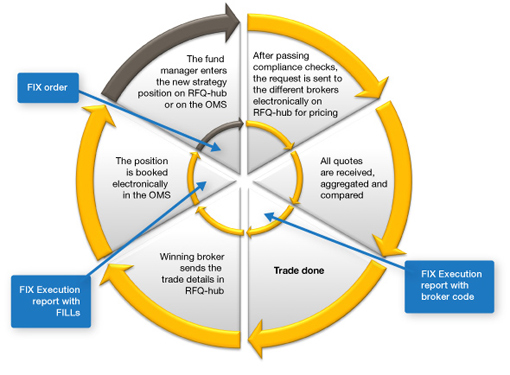

This flexibility enables you to have equal execution quality and market awareness whether on r8fin mobile and web application services or utilizing your firm s oms ems to route orders into r8fin fix hub.

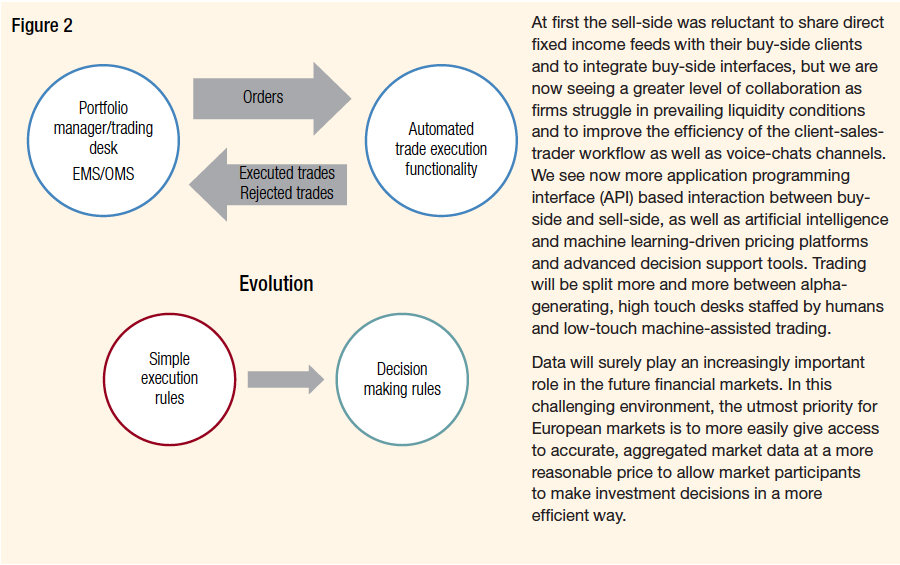

Trading desk workflow. The desk provides buy side traders with precise detail on the macro drivers events and plans that are shaping liquidity and price discovery in fixed income markets. This has and will continue to increase the demand for multi asset class execution management systems ems to be used in conjunction. A hybrid execution desk means you can watch your markets gain access to your analytics and route your orders to an expert execution broker 24 hours a day 5 days a week. The desk s trading intentions survey 2020.

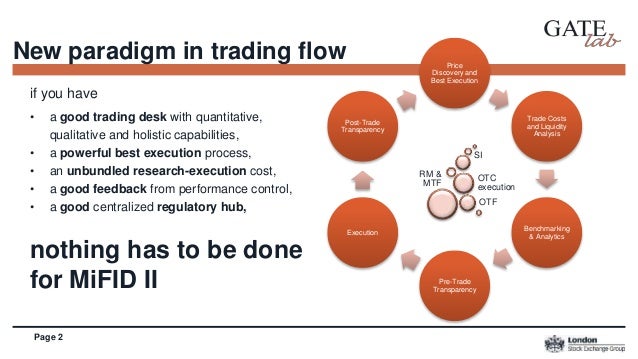

To provide the triage needed to separate orders between execution styles trading desks need to have the right order and execution management systems to reduce manual intervention in the workflow. Manage the trading strategies for your equity trading desk with ease from beginning to end. The idea behind this is that the buy side client can use the outsourced trading desk integrated into the buy side workflow under the hybrid model to cover geographies that its internal desk does not currently trade access parts of the liquidity spectrum out of the internal desk s reach or deal with difficult transactions that require anonymity for minimal market impact and to preserve alpha. Unpicking the buy side workflow on the desk.

Flexible customizable and robustly supported neovest streamlines workflow empowering efficient and confident trading. Trading desks generate an income by charging a commission on trades they transact. Trading and technology collaborating for the future on the desk. While the bot has only been live on the jpmam equity desk since q1 this year joseph said that betsi is already showing promising results in terms of its operational efficiencies and added value to the trading workflow whereas quantifiable metrics may be harder to come by for some of betsi s functionalities.

For example a hedge fund may deal through an equity trading desk at an investment bank and pay a modest fee for. Our award winning execution management system offers trading functionality powerful workflow and compliance tools and rich analytics via desktop cloud and api. The desk delivers facts from the frontline of trading opinion on the potential of new initiatives and support for fixed income desks across investment firms.